Interact Analysis

Global component electrified powertrain revenue for medium and heavy-duty trucks ($8.6 billion) will exceed that of buses ($6.1 billion) for the first time in 2023, according to Interact Analysis’ latest commercial vehicle report.

Prior to 2023, buses led the way for many years due to the higher percentage of vehicles electrifying, led by China (70% of buses registered in China in 2023 are forecast to be zero emission). However, global truck powertrain revenue is now higher. This is largely because there are so many more trucks sold than buses, so that with only a small percentage of medium and heavy-duty trucks electrified (2.6% globally in 2023) it still means significant component revenue.

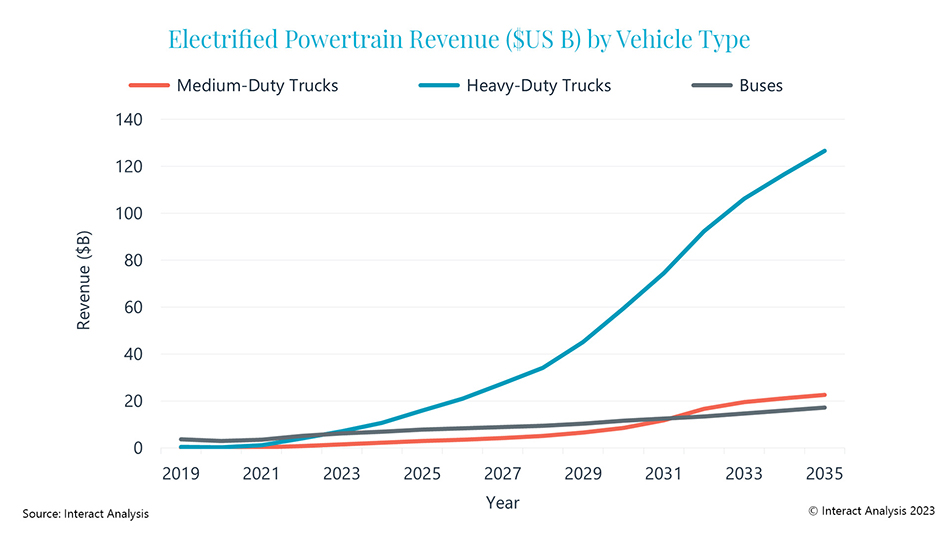

As the graph below shows, much of the revenue is forecast in heavy-duty trucks, especially in the longer term. These large class 8 trucks weigh from 15 to 37 tons, with many towards the upper end of the range. Larger trucks are hard to electrify and there are infrastructure challenges, particularly when they are used for longer distances. However, the substantial electricity savings per mile still make many models attractive candidates for electrification. Additionally, the large size of the vehicle means that revenue per vehicle is high for component manufacturers. A heavy-duty truck in the Americas has an estimated average powertrain value of $229,863 per vehicle in 2023.

Electrified powertrain revenue for heavy-duty trucks to climb sharply out to 2035

Revenue calculations are based on the units of vehicles sold, our research on powertrain architecture, and pricing data collected from detailed primary research into component suppliers in Europe, North America, and Asia Pacific.

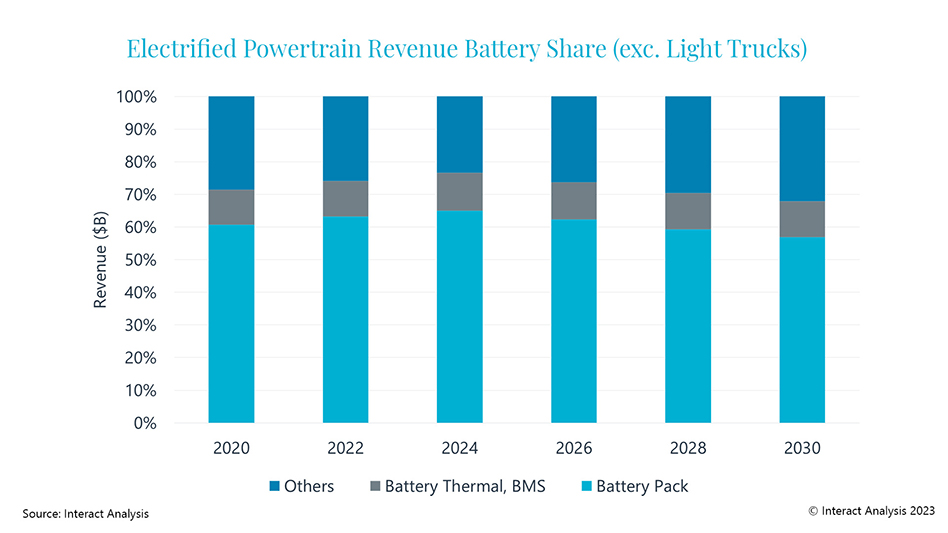

The battery pack is responsible for the largest share of electrified powertrain revenue

All about the battery

The battery pack dominates revenue share, as can be seen from the chart below. Including the BMS and thermal, its share is over 70% of the total. However, inverters, onboard chargers and PDUs have less competition and a higher profit margin, and so also contribute significant revenue.

Electrification of larger trucks gains momentum

The increase in medium and heavy-duty truck powertrain revenue marks an important shift in the electric vehicles market. Until recently most of the activity was in passenger cars (including SUVs), buses, and smaller trucks (including pickups and vans). Over the coming years, larger electric trucks will become a much bigger opportunity, as well as a larger contributor to decarbonization efforts. A mile in an electric truck avoids a lot more CO2 than a mile in an electric car. Furthermore, the annual mileage of trucks, especially larger trucks, tends to be much higher, which adds to the CO2 savings when replacing a fossil fuel vehicle with an electric vehicle.

The Tesla Semi grabbed a lot of attention in this area. If Tesla can eventually come close to the low price point it initially offered, using its technological knowledge and production methods, then it will do well. However, some sources who spoke to Interact Analysis think certain customers will prefer the known quantity of an existing truck manufacturer. Vehicles already on the market include the Renault E-Tech range, Peterbilt 579EV, Mercedes eActros, Freightliner Ecascadia, Volvo VNR electric, and BYD 8TT. In fact, most truck manufacturers now have an electric vehicle on the market or have plans to introduce one.

BEVs will dominate powertrain revenue

Most of the forecast powertrain revenue is for BEV powertrains. A consensus has developed that full battery-electric, rather than hybrid, is the way forward. Hybrid vehicles lack regulator support, have few (if any) major OEMs focused on them, and are sometimes referred to as “the worst of both worlds” as they have all the servicing, maintenance and parts of electric and conventional vehicles combined. Most OEMs are now pursuing a fully electric, zero-emission solution, at least for the long term, with battery electric generally winning out over hydrogen in the boardrooms of most commercial vehicle companies owing to the lower cost. Battery electric vehicles in particular offer an excellent per mile running cost. However, hydrogen is still on the radar of many companies, either as a) a backup plan, b) for use in certain niches (such as longer distances of 500 miles per day and areas with a good hydrogen supply like ports), or c) as part of a dual strategy to sell both vehicles, hedge bets, and let the market decide.

While this insight has focused on trucks, electric buses remain a strong market in territories such as China, Europe, India, and South America. In some places, for example in the Netherlands, Scandinavia, and other market in Europe, electric buses are becoming the default.

Interact Analysis’ latest report, on Electrified Truck and Bus Powertrain Components includes extensive forecasts by powertrain, vehicle type and region for both trucks and buses.

Latest from EV Design & Manufacturing

- Powering homes with EV batteries could cut emissions, save thousands of dollars

- Meviy introduces stainless steel passivation option for CNC, sheet metal parts

- December Lunch + Learn webinar with Fagor Automation

- December Lunch + Learn webinar with LANG Technik + Metalcraft Automation Group

- EVIO makes public debut with hybrid-electric aircraft

- Redesigned pilot step drill triples performance

- Green Energy Origin expands battery electrolyte manufacturing in North America, Europe

- What’s next for the design and manufacturing industry in 2026?