MarketWatch Guides

We’re officially living in the age of the electric vehicle (EV). Global sales of EVs surpassed 10 million in 2022, and the International Energy Agency (IEA) projects this figure to nearly quadruple by 2030. In the U.S. alone, there are currently 3 million EVs on the road and more than 130,000 public charging stations — and those numbers will continue to grow.

EV’s continual rise in popularity will have a wide impact on different areas of the automotive industry. So, what does this rapid increase in EV sales mean for auto insurance? In this article, the MarketWatch Guides Team will examine the rise of EVs and what it means for both consumers and car insurance companies.

Key takeaways:

- According to the IEA, worldwide EV sales are projected to grow to nearly 37 million by 2030 — almost four times as many as in 2022.

- Although EV drivers typically pay higher-than-average insurance rates, costs to insure EVs should fall as vehicle prices moderate and auto insurers adjust coverage options.

- High MSRPs and repair costs are two of the leading factors that contribute to EVs’ expensive car insurance rates.

What the rise of EVs means for consumers

EVs come with a wide range of benefits for consumers beyond lower fuel costs: they have fewer moving parts that can break down, they don’t need oil changes and they’re generally easier on brake systems than their gas-powered counterparts. However, EVs also come with higher price tags, meaning they cost more to insure than traditional combustion-engine vehicles.

Why are EVs more expensive to insure?

Along with the fact that EVs cost more than most traditional cars, their parts are more expensive to repair and replace. According to Kelley Blue Book, these are two primary reasons consumers see higher car insurance premiums for EVs.

In March 2023, the average price of a new EV reached $58,940. This is more than $10,000 higher than the industry average cost of a new vehicle at that same time, which was $48,008. Because a vehicle’s MSRP directly impacts the cost of car insurance, EV owners are bound to see higher costs for coverage.

High repair costs play a significant role in determining EV insurance premiums as well. While there are fewer components at risk of breaking down in an EV, the parts that do require repair or replacement are much more expensive. This is especially true if an EV’s battery pack is damaged. ConsumerAffairs found the average cost to replace an EV battery ranges from about $4,500 to nearly $18,000.

EV owners also face a shortage of qualified repair shops and technicians. The specialized training required to repair electric vehicles means fewer available options and higher charges for customers when repair needs arise. All these factors drive up insurance costs for EV drivers.

What can consumers expect from EV insurance costs?

As electric vehicles become more common and represent a larger percentage of vehicles on the road, repair costs and MSRPs are sure to come down — and insurance costs will follow suit. Soon, however, you can expect to pay higher premiums for EV insurance compared to coverage costs for standard vehicles.

We reached out to Nick Vitali, a licensed insurance agent with more than 14 years of experience specializing in personal lines insurance, for his insight into how more EVs will affect consumers. While he agreed that high repair costs will continue to drive higher insurance premiums, Vitali noted that it’s not all bad news for EV drivers. He stated, “Some insurance companies actually offer discounts or incentives for EV owners because they’re more eco-friendly and are involved in fewer fire-related accidents.”

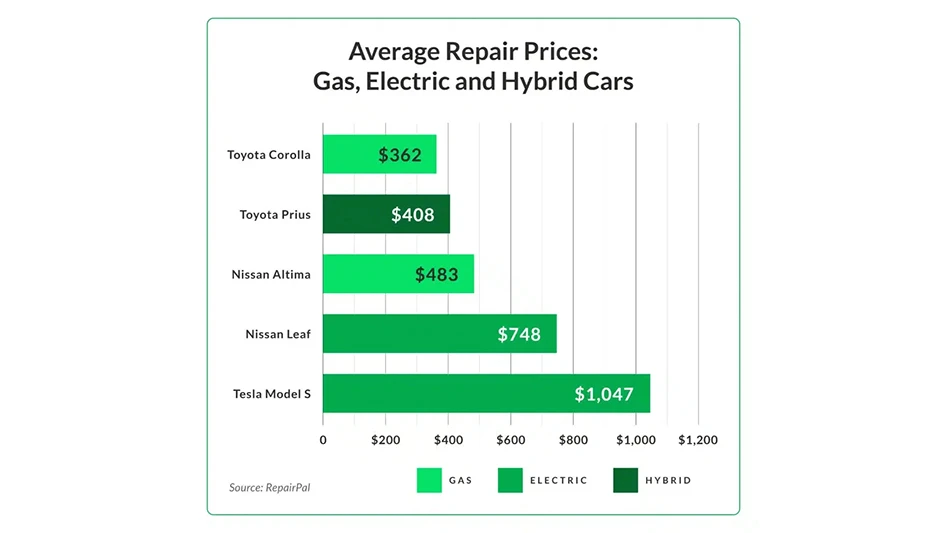

Repair costs: EVs vs. gas and hybrid vehicles

For additional context, we investigated some annual repair cost estimates from RepairPal. The following table highlights yearly repair costs for popular EV models as well as those of gas-powered and hybrid alternatives:

As you can see, repair costs do tend to be higher for electric vehicles, though how much can vary depending on factors like the brand and type of vehicle.

Average insurance costs: EVs vs. gas vehicles

To gain more insight into EV insurance costs and how they compare to those of gas-powered cars, we gathered annual premium estimates from Quadrant Information Services. The average rates in the table below are for 35-year-old drivers with good credit and clean driving records. They represent projected costs for full-coverage car insurance policies, meaning they include minimum-liability insurance as well as collision and comprehensive coverage.

Electric cars tend to be more expensive when it comes to average insurance costs as well, though it varies by a vehicle’s make, model, and year. The national average cost of full-coverage car insurance in 2023 is $2,024 per year. Coverage costs for the electric vehicles on this list are higher than the national average by anywhere from 10% to 135%.

How can EV owners save on car insurance costs?

Although not having to pay for gas or oil changes will help EV drivers save on traditional car ownership costs, they can also offset higher insurance costs by taking advantage of local, state, and federal rebate programs.

At the state level, for instance, Colorado offers up to $8,000 in rebates for residents who buy or lease an electric vehicle, and low-income California residents may qualify for more than $30,000 in incentives toward the purchase of a new EV. Utility companies in many states offer rebates and incentives to consumers who install certain EV charging systems in their homes as well.

There are also federal tax credits available for owning certain EV makes and models. The 2022 Inflation Reduction Act offers a tax credit of up to $7,500 for those who purchase a qualified EV with at least seven kilowatt hours of battery capacity. This credit was extended through December 2032.

Beyond credits and rebates, taking advantage of available car insurance discounts through an insurer is a great way to save. Most major insurance companies offer savings opportunities for safe drivers, policyholders who insure more than one vehicle and those who bundle their auto coverage with another policy. Opting for a higher deductible can also lead to lower premiums, although this means drivers are responsible for more out-of-pocket costs if they need repairs.

Because we’ll likely see some volatility in EV insurance costs in the years to come, comparing car insurance quotes from multiple providers will be more important than ever. This is one of the best ways for EV drivers to find quality, affordable coverage that fits the needs of their situation.

What the rise of EVs means for insurers

The rapid growth of electric vehicles is already spurring change among car insurance providers, with more adjustments surely on the way. “Insurance companies will need to revamp their underwriting models and risk assessments to factor in the unique characteristics of EVs,” Vitali said. “Things like battery range, charging infrastructure and the availability of qualified repair shops will play a part in determining premiums.”

Higher costs for collision coverage

Perhaps the most obvious change EVs will bring about for insurers is the increased cost of collision coverage. This type of insurance pays for damage to your vehicle when you cause an accident.

Replacement parts and repairs are more expensive for EVs than for conventional gas-powered cars. As mentioned earlier, this situation is compounded if an electric vehicle’s battery is damaged in an accident. Insurers will need to manage this risk with elevated rates for collision coverage for EVs.

Will home charging require additional insurance?

Charging an EV at home adds another level of consideration for insurance companies. There are two basic levels of home charging for EVs:

Level 1: This involves using the charger that came with your EV, which can be plugged into any standard 120V outlet. Level 1 charging is convenient and easy to set up, but it’s slow compared to other charging methods.

Level 2: Chargers for this method are sold separately from your EV. Level 2 charging requires a 240V outlet similar to those used for heavy-duty appliances like clothes dryers. This type of charging is three to seven times faster than Level 1 charging.

Level 1 charging doesn’t require any additional changes to a home and is a straightforward charging option. Although a Level 2 home-charging setup generally involves the installation of a new 240V outlet, insurers don’t require EV owners to buy additional homeowners insurance. However, some insurance companies may require proof that the home-charging unit is properly installed.

Additional training and new policies

Car insurance providers will have to make some changes to the way they do business as EVs increase in popularity. This is especially true when it comes to claims. As Vitali put it, “The insurance folks might have to provide specialized training to their staff so they can handle all the EV-related claims.”

There’s also a good chance that we’ll see new types of car insurance policies become available to accommodate emerging EV-specific needs. According to Vitali, “As the EV market keeps growing, insurance companies may come up with new policies or expand coverage options specifically for EV owners, keeping an eye on the ever-evolving trends in the electric vehicle industry.”

The Rise of EVs: Conclusion

The story of how EVs will affect the car insurance industry is still to be written. What we do know is that insurers will need to adjust coverage options and train agents to smoothly handle EV-related claims as they grow alongside EV market share in the U.S. While consumers are currently paying higher-than-average premiums to protect their electric cars — and can continue to expect high costs soon — average premiums will likely level out as the market adapts to the rising number of EVs on the road.

Latest from EV Design & Manufacturing

- Powering homes with EV batteries could cut emissions, save thousands of dollars

- Meviy introduces stainless steel passivation option for CNC, sheet metal parts

- December Lunch + Learn webinar with Fagor Automation

- December Lunch + Learn webinar with LANG Technik + Metalcraft Automation Group

- EVIO makes public debut with hybrid-electric aircraft

- Redesigned pilot step drill triples performance

- Green Energy Origin expands battery electrolyte manufacturing in North America, Europe

- What’s next for the design and manufacturing industry in 2026?