2019 auto sales: 5 years north of 17 million

Sharp demand declines that analysts feared failed to materialize in 2019 as shoppers continued to flood showrooms.

Sales fell about 1.2% in 2019 to close the year at 17.1 million – a 200,000-unit decline that could be explained entirely by the discontinuation of Ford’s Focus and Chevrolet’s Cruze compact cars. Significantly better than analysts expected, sales benefited throughout the year from a strong economy and low interest rates.

General Motors (GM): 2.89 million, down 2.3%

The end of Cruze production in April drove nearly 95,000 sales out of GM’s annual total, reducing Chevrolet and the automaker’s overall sales down. Buick, Cadillac, and GMC all gained slightly as growing crossover sales made up for fewer cars.

Ford: 2.42 million, down 3.0%

The Focus, cancelled in late 2018, cost Ford nearly 101,000 sales, and without the compact car’s numbers, Ford sales were up 1.1%. Commercial trucks and an 11.7% increase for Transit vans offset sagging car and SUV numbers.

Toyota: 2.38 million, down 1.8%

Last year, cars were 35.7% of Toyota’s sales, down slightly from 2018. That might sound truck-and-SUV heavy, but Ford’s at 14.4% cars, and GM’s at 13.6%. Toyota’s SUVs, other than the Rav4, also declined, failing to offset weakening car numbers.

Fiat Chrysler Automobiles (FCA): 2.20 million, down 1.4%

Booming Ram pickup sales (up 18%) failed to overcome losses at Jeep, Chrysler, Dodge, Fiat, and Alfa Romeo. Even at Jeep, pickups were key as the Gladiator variant of the Wrangler reached more than 40,000 sales.

Honda: 1.61 million, up 0.2%

One of only two major automakers to improve on 2018, Honda’s car numbers fell less than its competitors. Civic compact and Fit subcompact sales were flat, and doubling Insight electric/plug-in hybrid/fuel-cell vehicle sales made up for Accord sedan losses.

Nissan Motor Co.: 1.35 million, down 9.9%

Unlike other automakers that improved as the year progressed, Nissan’s numbers kept falling, declining nearly 30% in December. With sales of nearly all models falling, Nissan executives have promised big investments in new North American products.

Hyundai/Kia: 1.30 million, up 3.7%

Following flat numbers in 2018 and losses in 2017, Hyundai and Kia’s gains show a SUV-heavy response. Hyundai’s Palisade and Kia’s Telluride large SUVs account for nearly all of the company’s growth as cars continue to decline.

Tesla: 367,500, up 49.9%

Worldwide, Telsa sales were up nearly 50% as it continued to increase build rates for its lower-cost Model 3 electric vehicle (EV). With a new plant in China to produce vehicles for that market and a third planned for Germany, more of the automaker’s California output could remain in the U.S. this year.

For other automakers, electric car sales were mixed:

- Chevrolet Bolt: 16,418, down 9%

- Nissan Leaf: 12,365, down 16%

- Audi eTron: 5,369, new for 2019

- Volkswagen eGolf: 4,863, up 259%

- BMW i3: 4,854, down 21%

- Hyundai* Kona EV: 3,605, no 2018 numbers available

- Hyundai* Inoniq EV: 1,641, no 2018 numbers available

- BMW i8: 1,102, up 43%

- Honda Clarity*: 576, no 2018 numbers available

- Jaguar I-Pace: 752, new for 2019

- Porsche Taycan: 130, new for 2019

*EV model only, Hyundai and Honda sell hybrid, plug-in hybrid, or fuel-cell variants as well

The right call

While cancelling the Cruze and Focus led to year-end sales declines for Ford and GM, the market clearly doesn’t miss the two cars. Including the two cancelled compacts, that market was down 18% – without them, the market was still down 5.2%. Toyota Corolla and Honda Civic sales were flat (up less than 0.2% combined).

Tesla doesn’t release market-by-market sales totals, making it impossible to make apples-to-apples comparisons of its sales, but analysts estimate that about two-thirds of its production goes to the U.S. At that level, the fast-selling Model 3 would have been the No. 3 compact, behind the Corolla and Civic but ahead of Nissan’s Sentra, Hyundai’s Elantra, and Kia’s Forte.

Latest from EV Design & Manufacturing

- Additive manufacturing trends, innovations

- ChargeX Consortium proposes solution to increase reliability of electric vehicle charging

- Barcode readers offer reliable scanning across range of manufacturing applications

- Industry leaders partner to deliver load management, smart charging and energy solutions

- Anti-vandalism systems designed to increase electric vehicle charging station security

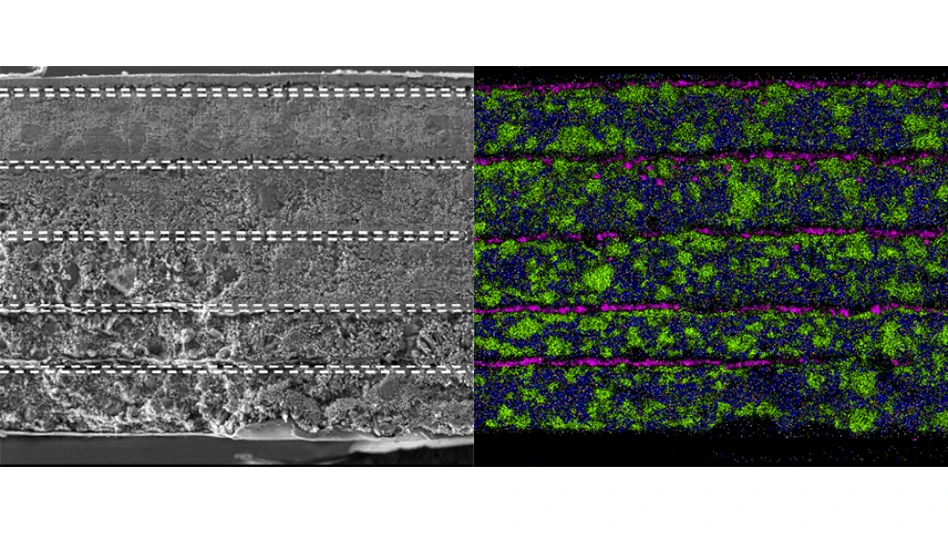

- GM selects Vianode as anode graphite supplier for electric vehicle batteries

- AMADA WELD TECH introduces blue laser technology into micro welding portfolio

- Despite hurdles, consumer interest in electric vehicles is rising